FAQs

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

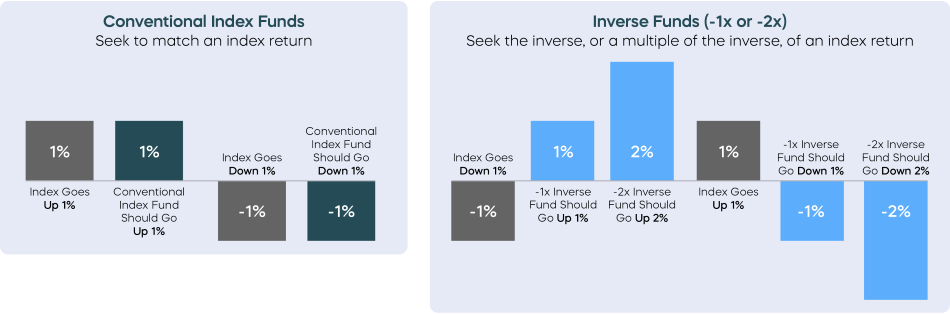

An inverse fund with a -1x daily objective should:

- Go up by approximately 1% on a day when its benchmark goes down by 1%.

- Go down by approximately 1% on a day when its benchmark goes up by 1%.

Some inverse funds also magnify performance. An inverse fund with a -2x daily objective should:

- Go up by approximately 2% on a day when its benchmark goes down by 1%.

- Go down by approximately 2% on a day when its benchmark goes up by 1%.

These examples are highlighted in the charts that follow:

ProShares may distribute net investment income earned by the funds, if any, on a monthly or quarterly basis, depending on the fund. Some ProShares may make capital gain distributions generally on an annual basis. Distribution information is posted on our website. For funds that provide tax information on Schedule K-1, such as our Commodity, Currency, VIX Futures and Managed Futures funds, additional information is available in Taxation FAQs for VIX Futures, Commodity, Currency and Managed Futures ProShares.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Contrary to popular belief, Lorem Ipsum is not simply random text. It has roots in a piece of classical Latin literature from 45 BC, making it over 2000 years old.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Contrary to popular belief, Lorem Ipsum is not simply random text. It has roots in a piece of classical Latin literature from 45 BC, making it over 2000 years old.

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour

This is not intended to be investment advice. Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.