TOLZ

ProShares DJ Brookfield Infrastructure ETF

We all need infrastructure to drive to work, to turn on the lights, to make a phone call. We can also benefit by investing in it. TOLZ’s pure-play approach may help you make the most of infrastructure’s potential.

Global infrastructure: An attractive investment opportunity

Infrastructure, which provides essentials such as transportation, communications, energy and water, is a potentially attractive investment. Here’s why:

- Strong, consistent demand for infrastructure has delivered stable, repeatable cash flows.

- Population growth, aging infrastructure and constrained government budgets are creating opportunities for the private sector.

- The high cost of entering the infrastructure business limits competition.

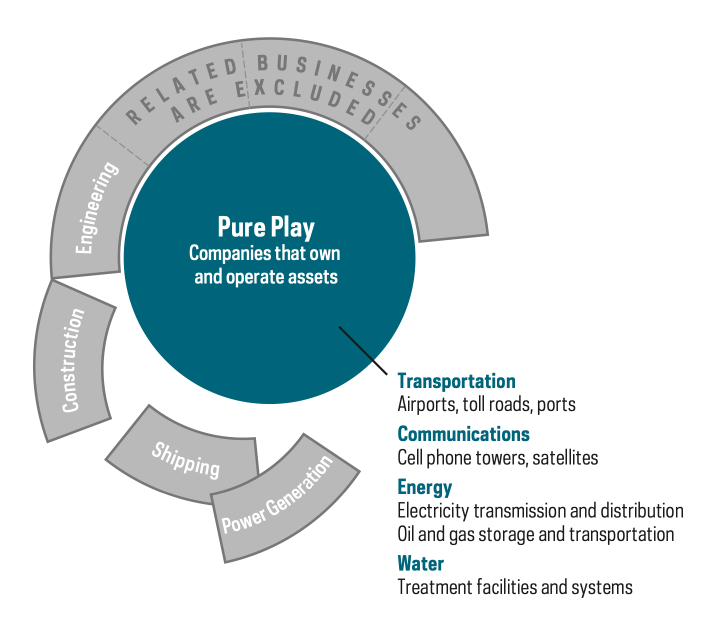

If you’re interested in infrastructure, you might want to consider a strategy that focuses exclusively on companies that own and operate infrastructure—a “pure-play” approach.

There’s only one place to get pure-play infrastructure in an ETF: ProShares DJ Brookfield Global Infrastructure ETF (TOLZ).

Why pure play?

- A pure-play approach focuses on the companies that actually own and operate the transportation, communications, energy and water assets that provide essential services to our society.

- Other infrastructure strategies may dilute their infrastructure investments with companies that supply services to the infrastructure industry.

Historically stable cash flows

- Pure-play companies tend to generate long-term, stable cash flows, because demand for their services rarely declines—it typically grows over time.

- Service companies are generally more dependent on the business cycle.

Potential performance benefits

- The pure-play approach has outperformed the index used by other infrastructure ETFs.

Advantages of TOLZ

Attractive investment potentialInfrastructure is poised for strong growth, with robust demand, limited competition, and increasing opportunity for private investment around the world.

Pure-play exposure

TOLZ invests exclusively in companies whose primary business is owning and operating infrastructure. TOLZ is the only ETF that offers pure-play exposure.

Strong risk-adjusted returns

TOLZ’s index, the Dow Jones Brookfield Global Infrastructure Composite Index, offers the potential for better returns with lower volatility than the MSCI World Index.2

Potential Risks

Index performanceThere is no guarantee the fund or its index will achieve intended objectives.

Global Infrastructure

Infrastructure companies in emerging and developed markets face a variety of risks. For example, governments can alter regulations and tax laws. Changes in supply and demand may reduce revenue. And natural disasters or other factors may render assets unusable or obsolete.

Master Limited Partnerships

MLP investments involve risks that differ from common stock investments, including risks related to limited control, limited rights to vote, and certain tax risks of investing in partnerships, among others.

1 From its inception on 7/14/08 through 12/31/2020, TOLZ’s index generated better returns with lower standard deviation than the S&P Global Infrastructure Index, which is followed by the broad infrastructure ETFs that are not pure play.

Source: Bloomberg and Morningstar. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. Current fund performance is available on the TOLZ fact sheet or by visiting ProShares.com.

2 From its inception on 7/14/08 through 12/31/2020, the Dow Jones Brookfield Global Infrastructure Index generated better returns with lower standard deviation than the MSCI World Index.

Source: Bloomberg and Morningstar. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. Current fund performance is available on the TOLZ fact sheet or by visiting ProShares.com.

Ticker Symbol

TOLZ

Intraday Symbol

TOLZ.IV

Bloomberg Index Symbol

DJBGICUT

Investment Objective

TOLZ seeks investment results, before fees and expenses, that track the performance of the Dow Jones Brookfield Global Infrastructure Composite Index.

Inception

3/25/2014

- Qualify as “pure-play” infrastructure companies— companies whose primary business is the ownership and operation of infrastructure assets.

- Qualify as “pure-play” infrastructure companies— companies whose primary business is the ownership and operation of infrastructure assets.

Take a closer look at PAWZ

PAWZ Holdings

Explore ProShares’ three-part series on portfolio hedging

A hedge is an investment intended to move in the opposite direction of an asset that’s considered to be at risk in a portfolio. A hedge provides inverse exposure—so if the at-risk investment should decline in value, the hedge is designed to increase in value and offset potential losses in a portfolio.

Explore Fund Holdings